Retirement savings that provide for your future and grow the Kingdom.

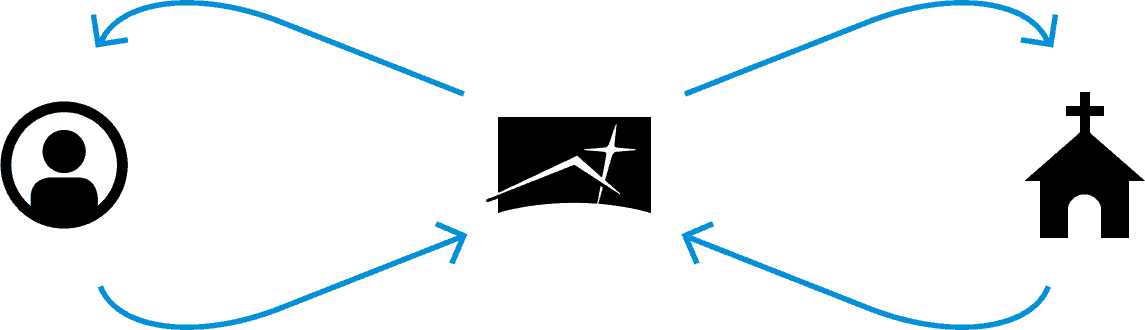

How it Works

Every dollar invested with CEP is assigned a mission — to empower ministry by funding church loans across the country. So while your retirement funds grow to benefit your family and future, they’re also used to enable Kingdom growth.

How We’re Different

While many retirement accounts invest in the stock market or bonds, your investment with CEP will grow by funding church loans for expanding ministries. We offer Traditional, Roth, and SEP IRAs as well as a 403(b) option for Assemblies of God ministries. You can open and fund your account with new contributions or transfer an existing retirement account from another financial institution. By putting your retirement funds with CEP, you will earn tax benefits, receive an excellent rate of return, and support Assemblies of God churches and ministries all along the way.

Partner with CEP and…

- Earn competitive rates

- Collect tax benefits

- Add to your account whenever you like

- Access your account anytime online

- Receive outstanding personal service

- Support Assemblies of God ministries nationwide

Retirement Options

- IRA

Our Traditional and Roth IRAs both grow tax-deferred, so your earnings will not be taxed until a later date. However, with our Traditional IRA, your contributions may be tax-deductible when you fund the IRA, so you’ll save pre-taxed dollars! With our Roth IRA option, you won’t pay taxes on qualified distributions when you withdraw funds at retirement.

- 403(b)

Our 403(b) ministry retirement plan is an employer-sponsored plan, available for qualified ministry staff of Assemblies of God ministries. With this plan, you’re able to deduct a portion of each paycheck and add it to your retirement fund with no taxes on your contributions or earnings until retirement.