Traditional and Roth IRAs that meet your needs and support your values.

How it Works

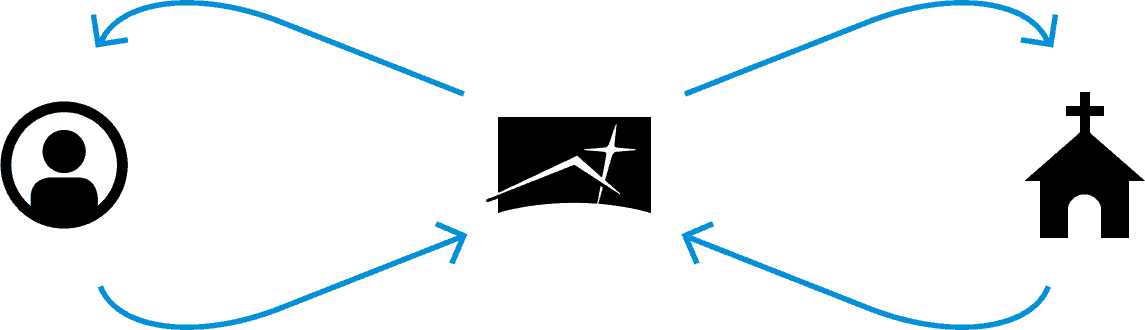

Every dollar invested with CEP is assigned a mission — to empower ministry by funding church loans across the country. So while your retirement funds grow to benefit your family and future, they’re also used to enable Kingdom growth.

Types of IRAs

Traditional IRA:

Your contributions may be tax-deductible when you fund your Traditional IRA, so you’re saving pre-taxed dollars. Instead, you will pay taxes on the distributions when you draw on your account at retirement. You can contribute to a Traditional IRA whenever you like for as long as you are working. All your IRA money benefits from compounding interest, so your account grows faster while also advancing ministries throughout America.

Roth IRA:

Your contributions are not tax-deductible with a Roth IRA, because you are contributing funds you have already paid taxes on. However, you won’t pay taxes on qualified distributions when you withdraw funds at retirement. You can contribute to a Roth IRA whenever you like for as long as you are working.

Coverdell ESA:

CEP also offers tax-deferred investing for college expenses. Our Coverdell Education Savings Account (ESA) can be used for qualifying educational costs, while you invest to support ministry.

| Traditional/SEP | Roth | Coverdell Education Savings Account (ESA) | |

|---|---|---|---|

| Contribution Limit: | Traditional:

SEP: See tax advisor |

|

|

| Annual Custodial Fee: | $10 | $10 | $10 |

| Eligibility: |

|

|

|

| Tax Benefits: |

|

|

|

| Withdrawals: |

|

|

|